Wine import tax USA demystified for wine importers

With €7.0bn worth of wine imported in 2022, the USA should be priority number one for wine importers. Every year, it consumes more wine than any other country and is also the world’s largest importer. However, it can be challenging to understand the ins and outs of all the regulations and calculate how much wine import tax USA authorities will impose on your shipments. Read on to find out the best way you can fulfill every requirement for importing alcohol in the USA.

How do I import wine from Europe to the USA?

The first thing to be aware of when importing wine into the USA is just how complex the system can be. Not only are there several layers of federal bureaucracy to navigate but you may also have to deal with different rules for each state.

The three main national bodies governing wine imports are:

- The Alcohol and Tobacco Tax and Trade Bureau (TTB)

- The Federal Food and Drug Administration (FDA)

- The Customs and Border Protection (CBP).

You must fulfill the requirements of each of these agencies and get the right licenses and documentation before you can start importing wine into the USA.

Thanks to the country’s legacy of prohibition, imported wine must pass through a strict three-tier system before it can be sold.

Here’s how it breaks down:

- Tier 1: Producers/importers including wineries and federally licensed importers who sell to distributors. This tier is responsible for paying federal excise taxes.

- Tier 2: Distributors which include wholesalers and state control boards. They are licensed by individual states and regulations vary from state to state.

- Tier 3: Retailers such as restaurants, bars, and stores who buy wine from Tier 2 distributors and sell it on to the public.

To get your wine through this process successfully, you’ll need to have all your paperwork perfectly in order.

Documents required include:

- A Federal Basic Importer’s Permit from the TTB.

- A wholesaler permit (if selling wholesale alcohol outside of imports).

- A Certificate of Label Approval (COLA) from the TTB for each wine product or label.

- Certificates of Age or Origin (applicable to wines from specific countries such as France or Spain).

- Proof of compliance with Natural Wine Certificate requirements if applicable.

- Proof of registration with the FDA for both you and the foreign winery where you source your wine.

- Registration of Prior Notice of Imported Foods.

If you are a wine producer based outside the USA you must have a US-approved importer or agent, such as Hillebrand Gori, to register certain documents for you.

Another important factor for wine importers to be aware of is that some relevant USA regulations and standards, such as road freight weight limits or pallet configurations, might be different from what you are used to.

How much is the import duty for wine in the USA?

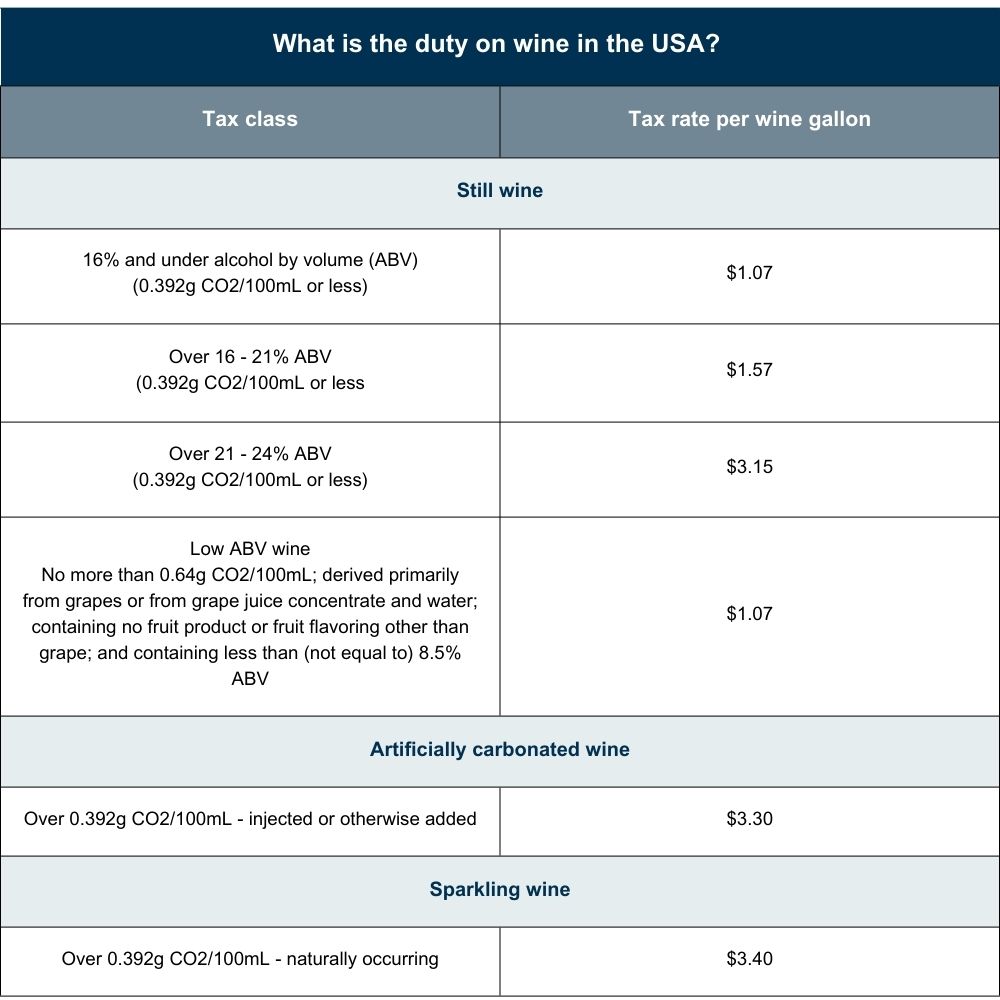

If you want to import wine into the USA, you will need to understand and pay all applicable federal excise and import duties for wine in the US. According to the Alcohol and Tobacco Tax and Trade Bureau, the wine import tax USA importers must pay is generally between $1 and $2 per liter. However, the duty on fortified wines can be much higher.

The specific duty rates for each type of wine are listed in Chapter 22 of the Harmonized Tariff Schedule (HTS), a database that lists import duties for alcohol in the US.

On the TTB excise page you can find out what excise taxes you will have to pay.

These can give you a rough idea of the duty rate for your wine. You will need to submit this rate as part of your paperwork, but working out the actual wine import tax USA authorities will ask you to pay on your wine may be more difficult than appears at first glance.

Classifying products is not a straightforward process and it takes tax professionals years to understand how to determine the rates accurately. The classification can vary depending on the country of origin, country of bottling, materials used in the packaging, and many other factors.

In the end, the CBP’s experts will decide the correct import duties for wine in the US, and it may not match your expectations.

Here is a summary of the tax rates for different classifications of wine as listed in the HTS:

Wine importers may be able to take advantage of tax relief which can bring considerable savings on excise taxes if you meet specific criteria.

Once registered with the TTB, foreign producers can register for tax credits on imported wine thanks to the Craft Beverage Modernization Tax Reform Act (CBMA).

For example, the standard tax on 30,000 gallons of imported wine gallon of 16% ABV or under would be $1.07 per wine gallon and total $32,100. With CBMA tax credits, the total would be just $2,100 - a saving of 93%.

Remember, if you’re going to import wine into the USA, you will also need to convert your wine measurements from metric to United States customary units.

Wine import tax USA simplified

To ship your wine to the world’s biggest market you will have to understand and comply with every requirement for importing alcohol in the USA, even down to getting the punctuation correct on your documents. So it’s worth considering what is the best way to make the process easier for you.

You can streamline your experience by using the services of a freight forwarder, such as Hillebrand Gori. Not only do we understand the best ways to transport your wine safely and in top condition, we can also help you work out the correct wine import tax USA rules require, along with handling customs brokerage, onboarding, and other necessary preparations. Our experts can have you set up and ready to go in as little as ten days.

Get in touch with us today and take the hassle out of importing your wine into the USA.

US federal regulations allow travelers to bring up to one liter (33.8 fl. oz.) of wine for personal consumption before you have to pay duty. individual states may have different limits.

Yes, wine with 24% ABV or less can be placed in checked bags without restrictions. However, only 5 liters (1.3 gallons) of alcoholic beverages between 24% and 70% ABV are allowed in checked bags for each passenger.

US wine producers must pay excise taxes, foreign wine is subject to the wine import tax USA authorities impose, and many wineries have to pay mortgages on their vineyards. All these costs are passed on to the consumer. Most producers in Old World wine countries do not have to pay excise taxes and many wineries have owned their vineyards for hundreds of years.

France exported around $2.8bn of wine to the US in 2022, making it the country’s top source of wine imports.

How can we help your business grow?