Industry sets shipping record: How did we get here?

The shipping industry is making history by setting a shipping record in three areas:

Ocean freight rates

Poor schedule reliability

Carrier profits

This situation shows no signs of easing up and spells trouble for the busy “seasonal” period ahead.

Download our full “state of the industry” report here.

How the industry is setting a shipping record with ocean freight rates

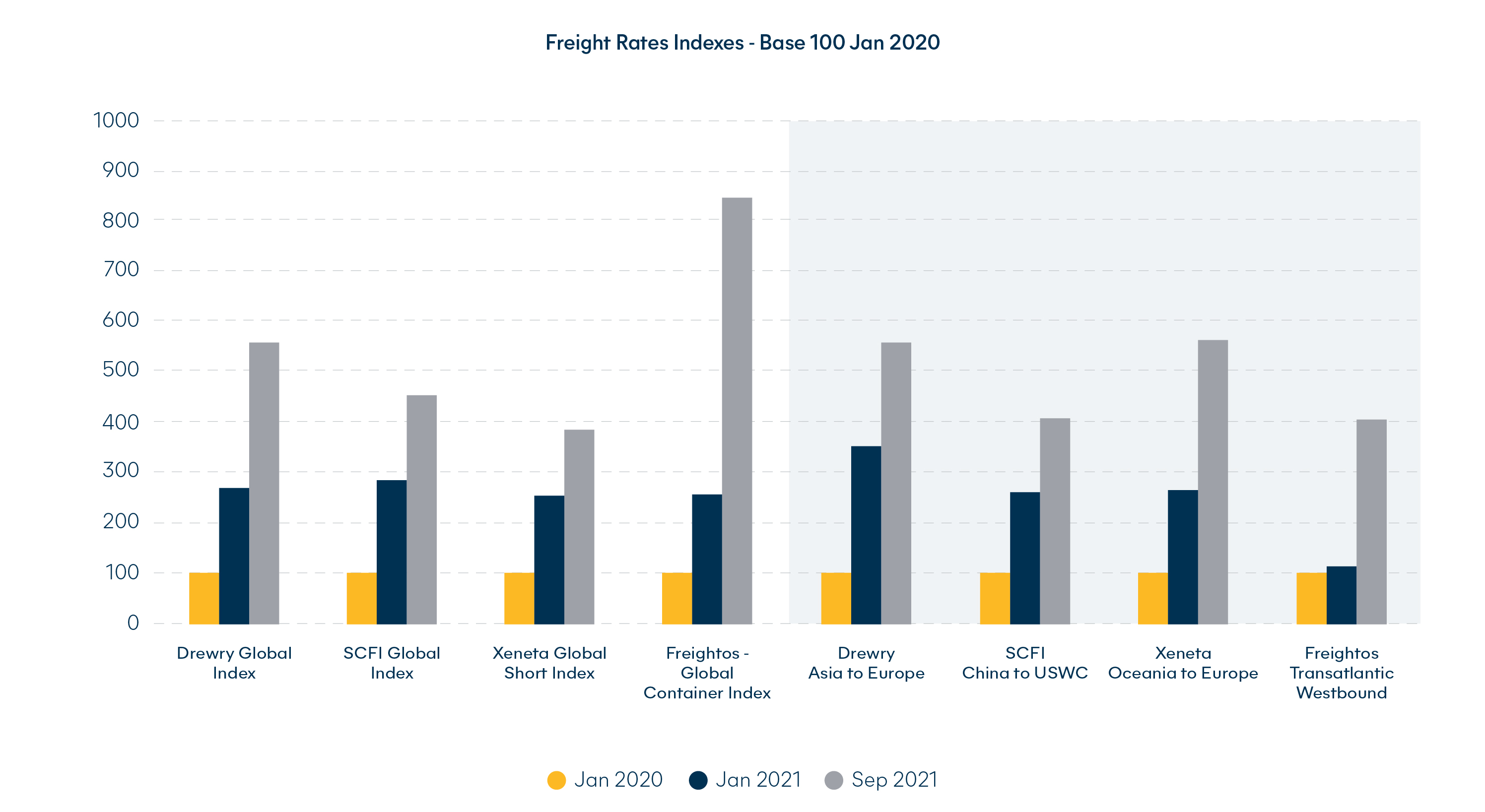

In September, the shipping industry’s main global ocean freight indexes reported consecutive rate increases for the sixth month.

For the first time, the Drewry index broke the $10,000 price tag for a 40-foot container, while Xeneta’s short-term rates index was four times higher than in January 2020.

How the industry is setting a shipping record with poor schedule reliability

During July and August, on-time performance took a summer holiday and fell to a troublesome -35%.

Why?

Continued and extreme after effects from:

Global port congestion and closures

Not enough containers

Not enough vessels and space

Suez Canal blockage, industrial actions, etc.

Bad weather and COVID-related slow-downs

In August, only 20% of global container ships were on time (Europe Asia trade) — a shipping record low.

How the industry is setting a shipping record with profits for carriers

While world trade is under massive strain, and the supply of materials and goods is unable to meet demand, container shipping lines are very much benefiting from everyone’s misfortune.

Maersk published its 2021 full-year earnings before interest, taxes, depreciation, and amortization (EBITDA) expectation at a jaw-dropping $22-23 billion!

While this sounds unfair and somewhat immoral, it’s a positive for all of us. Profit leads to investment, and the shipping industry needs to further invest not only in fleet and assets but also into the next generations of greener energies that ocean vessels will have to comply with in the years ahead.

We can only hope port infrastructure and haulage receive a likewise injection of funds.

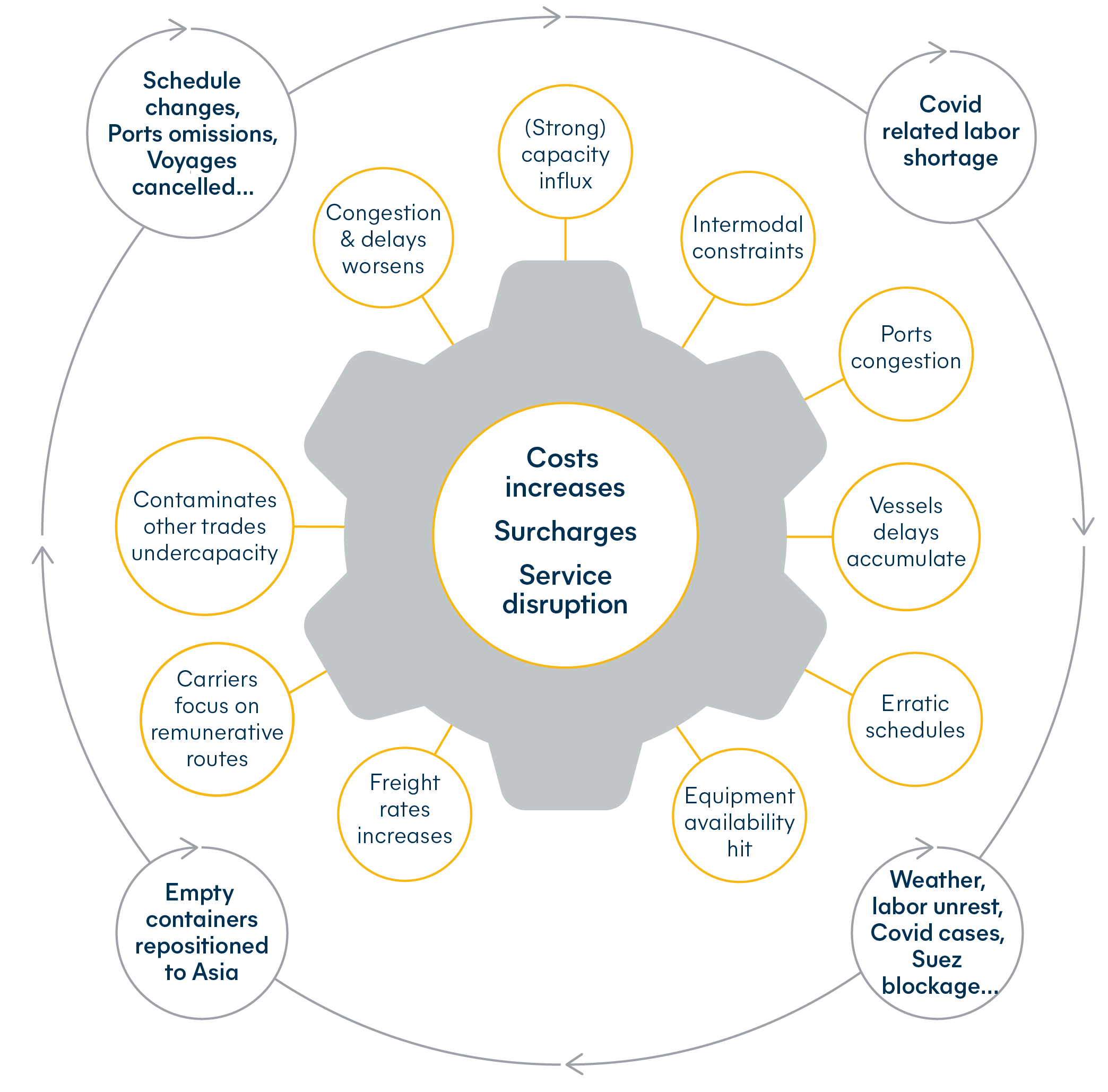

So did high freight costs, surcharges and service disruption become the norm?

In late 2019, the start of the COVID-19 outbreak made carriers pull capacity from the seas, and in May 2020, around 2.7 million TEUs were sitting idle.

What followed is the cause of where we are today.

The sudden upturn in demand from the US in the third quarter of 2020 initiated the market disruption. At that time, shipping lines were hesitant to redeploy their assets, and the slow introduction of the idled container fleet bore the situation we’re still unable to exit today.

Here are some quick figures for you.

Container demand grew:

+13% year-over-year (YOY) in September

+6% vs. 2019

Nominal capacity grew:

+4% in 2021

+15% vs. June 2020

It’s not news to know ports around the world are struggling. The average waiting time for vessels currently exceeds seven days, and approximately 70% of global container shipping vessels are late, according to their planned schedules.

As of October (2021), more than 300 vessels worldwide were queuing to berth at port.

There were close to 60 in Los Angeles/Long Beach alone!

And 13% of the world’s capacity was absorbed by delays (August 2021).

What to expect next…

With the industry setting a shipping record in ocean freight rates, poor schedule reliability and carrier profits, what can we expect?

Including their order book, the top eight ocean freight shipping lines, organized in three alliances, still control close to 85% of the world’s capacity.

The injection of capacity to help the global container shortage and vessel capacity expected in 2022 looks pretty low —lower than in 2021, in fact, and certainly lower than container demand growth expectations.

Shippers should focus on:

Increasing inventories, anticipate and allow for longer lead times.

Anticipate reduced container-free times.

Provide reliable forecasts to help with equipment needs.

Consider groupage/LCL solutions.

Consider air freight for urgent shipments.

Contact us today to learn how we can help your business grow.

-ebook-1---global-freight-forwarding/hil---cta-text-1---ebook-global-freight-forwarding-(1).png?sfvrsn=a2292c3e_3)

-ebook-1---global-freight-forwarding/hil---cta-post---yellow.jpg?sfvrsn=5e55bfc5_2)