The global shipping crisis: questions, answers and advice

Four answers for why cargo shipping transport costs will remain high

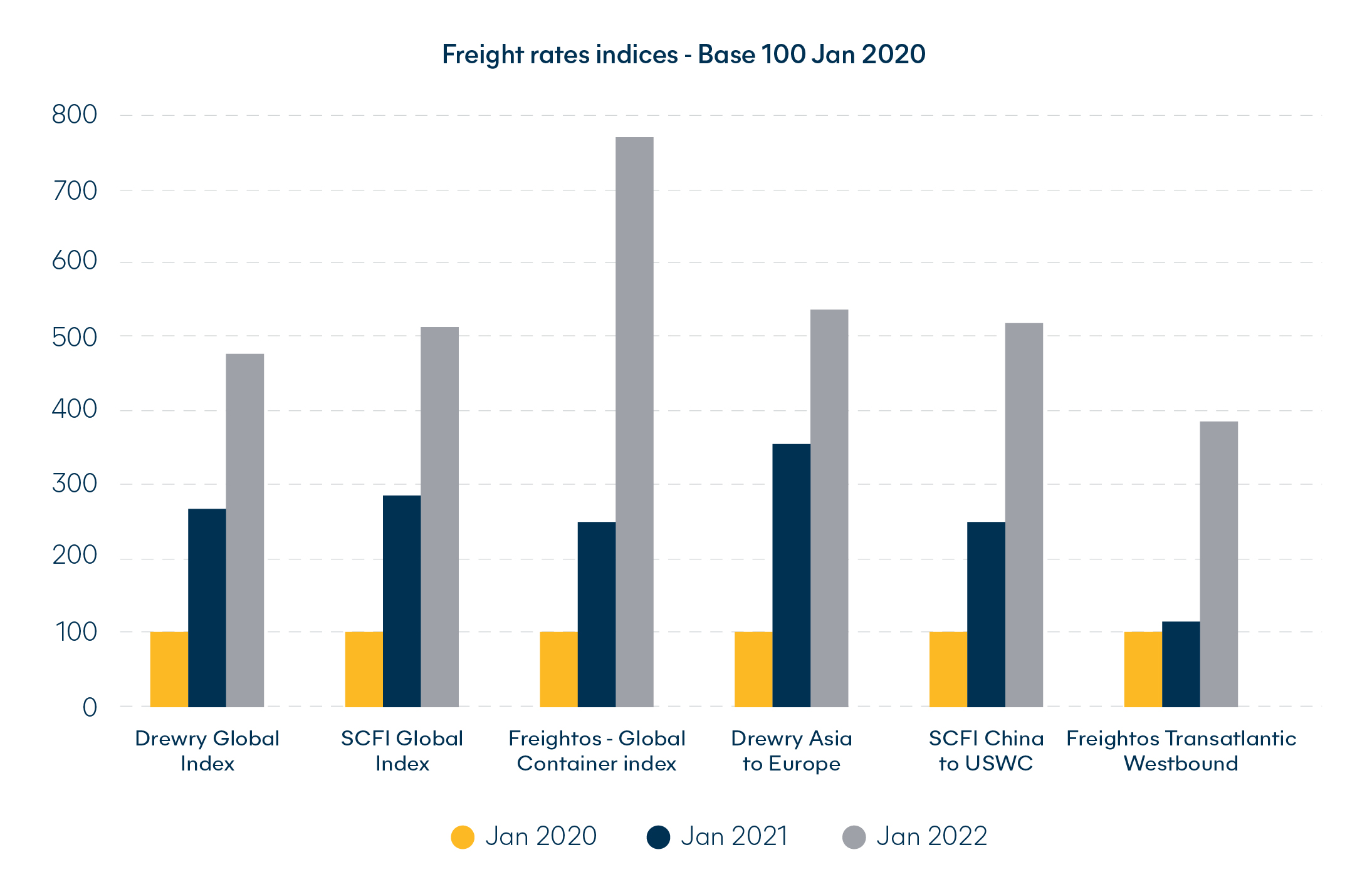

Spot short term rates exceed USD 20,000 on the Transpacific and are creeping up to the USD10,000 per container rate on the Transatlantic. Besides the obvious fuel costs, international freight shippers must expect:

Rates to keep increasing and remain volatile, unless committing long term

Terminal handling charges as well as port demurrage fees to increase

Landside costs to remain very high due to power shortages

Free time provisions to reduce and per day fees to increase, as carriers want equipment moving

Rates will not collapse though, as ocean freight carriers have learnt how to manage capacity.

Four questions which have us poised for further supply chain disruptions

As post Chinese New Year demand resumes, will port congestion be exacerbated?

With containers unable to move, how will freight shippers cope with further cost increases in demurrage and detention?

Will the political instability with the Ukraine and Russia crisis add to an already turbulent global shipping environment?

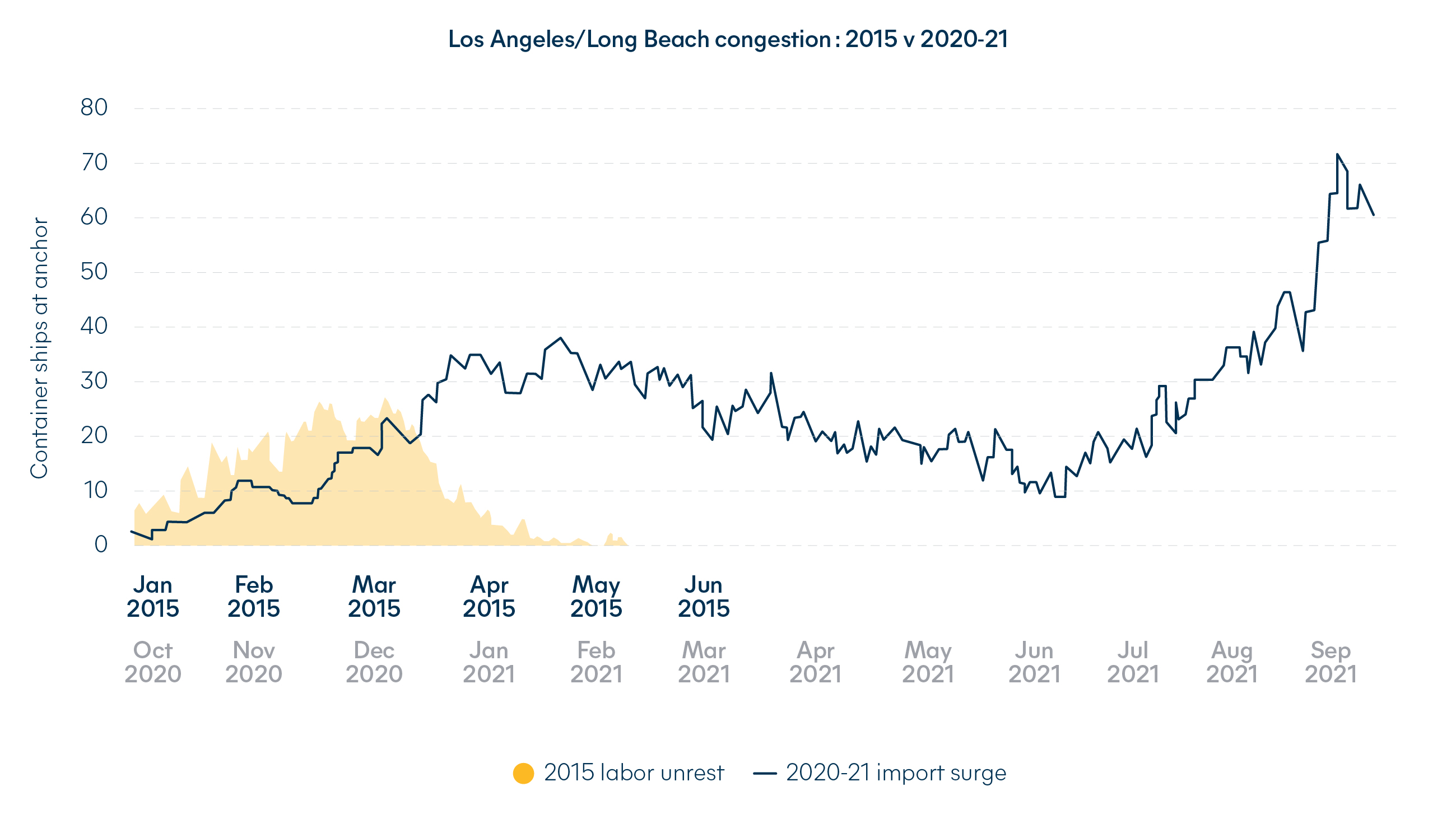

Would it be unreasonable to expect that the ILWU (California longshoremen union) contract renegotiations in June to add a new level of difficulty to US port congestion? Their last contract discussions in 2015 provoked the highest congestion and disruption levels California had ever gone through. At the time, that congestion was three times inferior to the current situation!

Four pieces of advice for international shippers from Hillebrand

Increase inventories, anticipate and allow for longer lead times

Adapt to reduced container free times, expect higher per diems linked to delays and landside bottlenecks

Prioritize long term contracts and secure capacity

Consider air freight alternatives for urgent flows

Read our latest State of the industry report here.

.png?sfvrsn=c3460e9d_1)