Global trade on the grapevine: Insights for wine importers

‘Money makes the world go around’ as the old saying goes, but so does global trade. However, in the last few years it’s been fairly chaotic for international wine importers, so it’s crucial to stay informed about how the industry is adapting. Keep reading for our analysis of global trade trends in the wine industry and what they mean for you.

What is global trade, and why is it important?

Global trade involves the import and export of goods and services across international borders. It’s driven by the demand from consumers and businesses for goods, such as wine, that are either more expensive or completely unavailable in their own countries.

Thanks to global trade, consumers have access to a wider variety of wine from all around the world. This is especially important for countries that consume more wine than they produce, such as the UK, which is the third biggest importer of wine in the world.

With billions of liters of wine being traded internationally each year, the global trade in wine is an interesting part of the world economy.

The 3 types of trade: export, import, and entrepot

The global trade in wine can be best understood by looking at imports, exports, and entrepot.

Wine exports happen when wineries send their wine to be sold in another country. There are 85 wine-producing nations in the world which export their products abroad. Any wine that is purchased and brought from one country into another is then considered an import. Wine exports can boost a country’s domestic economy by creating jobs and bringing in foreign currency, which adds to its GDP (Gross Domestic Product).

Entrepot is also known as re-exporting and involves importing wine from one country, storing it in a warehouse, then exporting it to another country where demand or prices are higher.

Global trade facts and trends 2019 to 2023

Decades of relative stability that allowed the wine industry to expand and flourish came to an end with the outbreak of the global pandemic in 2020.

Covid-19 reduced the consumption of wine through the hospitality venues like bars and restaurants, and retail became the main way for consumers to satisfy their demand for wine. The pandemic also caused serious disruptions to the supply chain and skyrocketing freight rates.

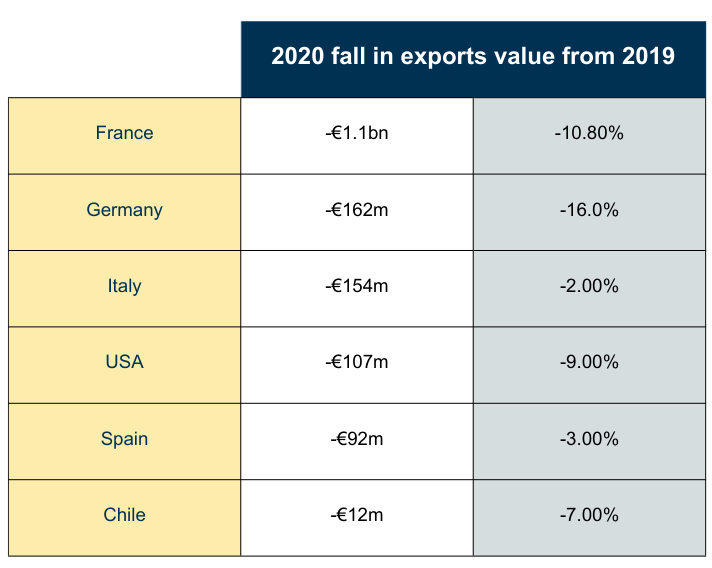

Along with an increase in some trade tariffs, this caused the total exports of all countries by volume to contract slightly by -1.7% compared to 2019. However, value fared much worse and fell by -6.7% to €29.6bn.

Many major wine-exporting countries saw large declines:

Global trade in wine 2021

However, in 2021, the story changed, 111.6mhl of wine was exported, the largest volume ever recorded. Value also increased with a huge 16% boost equating to €34.3bn.

2021’s largest exporter was Spain, regaining the top spot it had held for many years until Brexit and falling demand in China hit its exports in 2018. With a volume of 23.0mhl, it made up 21% of the global market. Other major producers that saw positive growth included:

- Italy (+1.5mhl)

- South Africa (+1.2mhl)

- France (+1.1mhl)

However, three top exporters saw declines in volume:

- Australia (-1.3mhl)

- Argentina (-0.6mhl)

- USA (-0.3mhl)

Australia suffered a drop mainly due to a steep rise in tariffs imposed by China which resulted in its -17% fall in volume.

As usual, thanks to high costs, the reputation of its wines and short supply compared to demand, France came first in terms of value, with wine exports rising by €2.3bn to total €11.1bn.

Most other major wine exporters also saw significant increases in value, except Australia, which suffered a loss of €435m, a -24% decrease, again mainly due to Chinese tariffs.

Global trade in wine 2022

However, just as the global trade in wine started recovering from the pandemic, 2022 saw labor shortages, high inflation, the Russian invasion of Ukraine, followed by energy and supply chain problems. Production and distribution costs shot up, leading to wine prices that averaged around 15% higher than 2021.

In response, wine consumption dropped globally by 1% to 232mhl, and exports fell by 5% to 107mhl. The EU, which makes up almost half of all worldwide consumption, saw a 2% decrease to 111mhl.

Spain, the leading exporter by volume in 2021, had the steepest drop in 2022, exporting 2.4mhl less, a decline of -10.2%. Italy reclaimed its number one position with 21.9mhl exported, down -0.6%.

Other major exporters also saw volumes fall, including:

- France -0.7mhl

- Argentina -0.7mhl

- US -0.5mhl

- South Africa -0.4mhl

On the bright side, customers still show a healthy appetite for wine from abroad, and a total of 46% of wine consumed around the world was imported.

Where 2021 broke records for volume exported, in 2022, the estimated €37.6bn in global exports was the highest value ever recorded. However, this 9% rise was due to sharp increases in the average price.

With wine exports up 10.9%, France again took the top position netting €12.3bn, nearly one-third of total global export value.

It was followed by Italy, which achieved €7.8bn thanks to a 10.1% rise, and Spain, which saw a 3.1% increase to €3.0bn in export value, a record for the country in spite of its sharp fall in volume.

Although swapping first, second, and third positions from year to year, the world’s top three wine importers from 2019 to 2022 have remained the USA, Germany, and the UK.

The US is currently the largest importer by volume. They consumed 41mhl in 2022, imported €13.1bn worth of wine and totalled 38% of the world’s export value. Its 14.4mhl marks a +3% increase on 2021, and a +17% rise in spending also puts it first in value with almost €7.0bn in wine imports.

What is the future of the global trade in wine?

The IWSR (International Wine & Spirit Research) has found that, while consumers are currently choosing to spend less on alcohol due to the cost-of-living crisis, they are feeling more optimistic compared to 2022.

“Beverage alcohol consumers are becoming more selective in how and when they spend on alcohol,” said Richard Halstead of IWSR Drinks Market Analysis.

“After the pandemic, at-home drinking is still preferred, but there is a strong motivation to go out, just with less frequency and more mindfulness in alcohol consumption and spending.”

Despite this, young adults have spearheaded a return to drinking venues in key markets. On-premise demand remains more or less steady in Europe and the Americas. Meanwhile, venues in China, Taiwan, and Japan are enjoying a growth in the number of drinkers.

However, a report by Straits Research predicts the overall global alcoholic drinks market will grow from US$1,603bn in 2022 to reach US$2,001bn by 2031 based on a compound annual growth rate (CAGR) of 2.5%.

The report highlights Europe as the region with the highest global market share for alcoholic beverages with demand strongest in Lithuania, the Czech Republic, France, Ireland, and Belarus.

While the US also remains a major market for alcohol, Asia Pacific demand is predicted to expand by 2.5% CAGR thanks to changing lifestyles, increased disposable incomes, and its significant population of young adults.

Amie, a newly founded UK wine brand, is already finding success in Asia. It expects to produce 400,000 bottles this year, with more than half of its exports going to South Korea, where the three-year-old firm is also opening a wine bar.

Worldwide, the growing global population of young adults, rising urban populations, higher disposable incomes, and increasing popularity of socializing, especially in emerging economies, are expected to drive demand over the coming years.

Wine importers who can position themselves to capitalize on this projected rise in alcohol consumption should enjoy a healthy future.

There are plenty of opportunities to be had in the global trade in drinks, even without alcohol. No and Low Alcohol (No-Lo), including wine, has reached almost US$10bn in key global markets.

A third of No-Lo drinkers choose these products because they like the taste, and 37% say they want to avoid the effects of drinking alcohol.

According to NielsenIQ, in October 2022, non-alcoholic wine sales in the US accounted for 13.4% of all sales at over $52m, up over 23% on 2021. Low-alcohol wine is predicted to enjoy almost +20% CAGR between 2021 and 2025, while no-alcohol wine should see growth of +9% CAGR.

In such a rapidly changing world, it’s tough to stay on top of all the latest developments that could impact your business. To best take advantage of all the benefits of global trade, you can work with a specialized beverage freight forwarder like Hillebrand Gori. Contact us today to learn more about how we can help or request a quote.

History’s first global trade route may have been the original Silk Road which was actually a network of routes that connected China to Rome. It lasted from 130 BC to 1453 AD and stretched around 6,437km (4,000 miles) across some of the world’s most inhospitable deserts and mountains.

Global trade makes the world economy more efficient. It allows goods, and services to be transported to where they are needed and increases productivity.

Global trade can be affected by many factors. Natural disasters, unpredictable exchange rates, political instability, and protectionism can all cause global trade to slow down.

On the positive side, trading services, digital goods, and e-commerce are growing and more regional trade agreements are being signed or negotiated. On the downside, trade sanctions and protectionist policies are increasing.

According to the United Nations inflation, along with higher energy prices, rising interest rates, and the war in Ukraine may lead to a slowdown in global trade in 2023.

How can we help your business grow?