Did the current ocean freight crisis begin over a decade ago?

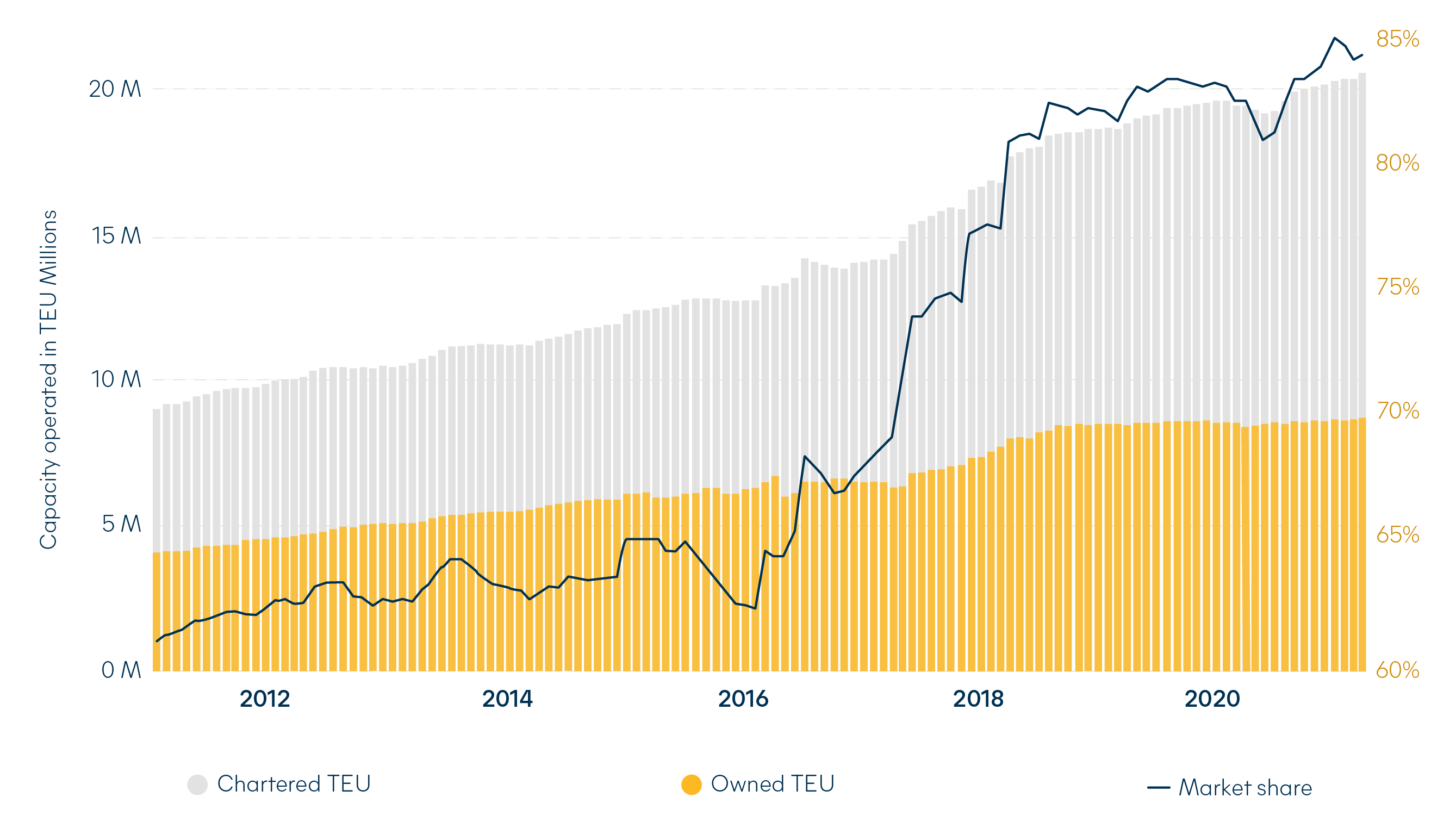

Were the foundations for the current ocean freight crisis laid over a decade ago? This is what were now asking ourselves. It was at that time carriers began to merge at a significant level and the concentration of equipment and vessel owners made us sit up and take notice. Today, 81% of the world’s ocean freight capacity is controlled by just 8 carriers.

Pierre Bonel, Chief Business Development Officer shares his thoughts…

"The alliances brought opportunities for moving goods to market. Larger ships were more efficient to operate in terms of energy, crew and volume per sailing. However, what we have seen more recently is that a dense pool of vessel owners has real limitations, when fronting a crisis like the one we find ourselves in now. These larger vessels put a strain on existing terminals due to their sheer size and their increase in demand for the number of containers needed to feed them. Note, most of those ‘mega vessels’ were deployed on Asian routes.

Once the Pandemic hit….

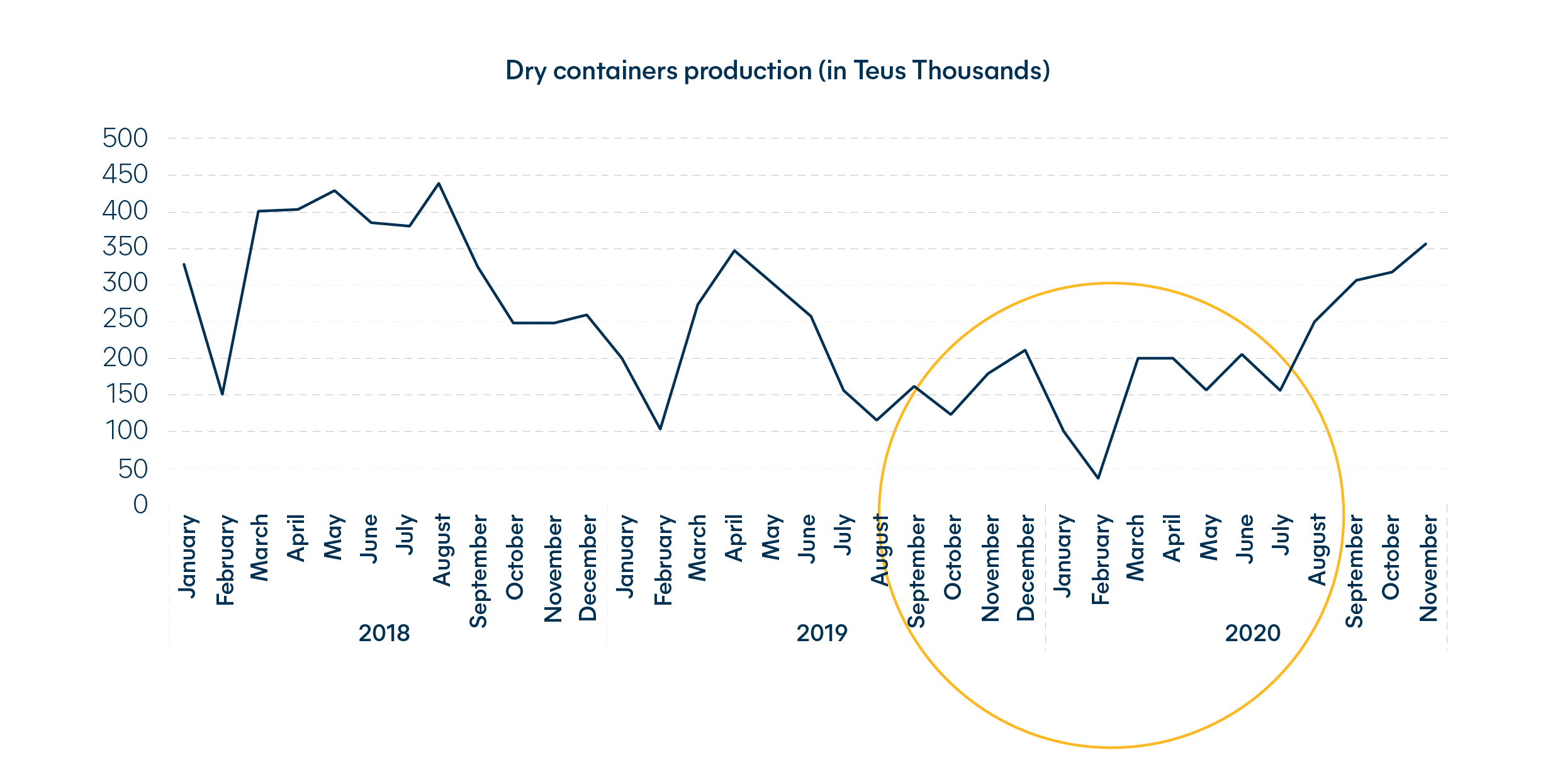

When Asia was hit by the pandemic, it started a chain reaction of events in global ocean freight that no one was prepared for. Stopping both the production and movement of

goods, from a part of the world that governs the majority share of international cargo freight. The dramatic downfall in container demand that started in Asia, soon followed in other parts of the world as lockdowns and safety measures were put into place. Global container production then

took a major dip in August 2019 which resulted in extremely low ratios of TEUs per vessel slots.

What happened next, was that the carriers started to flex their muscle memory from the 2008 economic crisis. Implementing what they had learnt and quickly introducing slow steaming and blank sailings as a way to control an unsettled environment.

The bounce back

The real catalyst for the situation were in now though wasn’t so much the downturn of global freight movements, but the boom that came after. Consumers took to the web for their purchases, which then heightened the demand for goods to be shipped. The volume of goods waiting for exporting started to pile up, which coincided with reduced vessel capacity and strained inland capabilities to manage freight.

Stevedore numbers were at an all-time low because of Covid-19 symptoms and restrictions. The port environment became inefficient and dwell time skyrocketed. At the peak of the crisis, Los Angeles port showed a berth wait time of 8 days! All of this together meant that the predictability and reliability of usual ocean freight services is suffering and as is the freight payers purse.

Are carriers taking advantage right now?

So why at a time of chaos and crisis do we see ocean carriers making a good profit? Initial thoughts may have you thinking they’re capitalising on a troublesome situation, when in fact we need to champion their success. Carriers operating near to bankruptcy is not a good thing, especially now. Just five shipping line carriers control 67% of all ocean freight. If one of them goes down, the impact on all other carriers is huge, furthermore that impact would be felt by everyone in the supply chain, right down to consumer. The truth is that we need them to do well, we need good sea vessels and we need good sea shipping services. They need to survive and thrive for everything else to work, and work well.

So at a time when we seem to pay more and get less, what does it mean to have a contract with a carrier? For Hillebrand, we try to spread our capacity across all our contracted carriers and offering what we call a ‘basket rate’ to customers. It’s where one freight rate to you has multiple shipping carrier options behind it. It alleviates the ever present issue of capacity by opening up more options across more vessels and sailings.

Where are we heading?

Without a crystal ball it’s hard to say with any certainty, but we are hopeful for more stability towards the end of 2021, latest Q1 end 2022. That’s a good adjustment period from which we should start to see improvements, with people returning to work in nearer to pre-Covid-19 conditions and new ocean freight containers in the market.

Freight rates will likely soften but are unlikely to return to previously too low levels, as they were damaging the ocean freight market and as already discussed, we need carriers to make money and invest it back into fleets and operations.

For the moment, long term planning is being replaced with short term goals. Though through the chaos it is becoming clearer that a greater focus on supply chain management and integrated logistics solutions. There is an ever present need to improve the flow of goods and the bottom line, as business try to recover and grow. A mind-set shift from looking at the singular shipping cost per freight container, to the wider financial savings that can be made to the business as whole, by integrating each element of the supply chain.

Extending leads time and moving away from the historical strategy of just-in-time delivery will also become more apparent. Considering how the management of stock at origin, on the water and at destination can be adjusted and re-thought to better run and protect the supply chain. It’s on that point as well that we have seen an upturn in the volume of product being shipped in bulk, not only wine but spirits, olive oil and juices as well. Bottling in-market and closer to the point of sale, has become for some customers a new way forward, taking advantage of more volume being able to move in a single container.

We’re here

These really are troublesome waters we all find ourselves in, but we are in it together and we will navigate through this challenging time. We are here to discuss the current ocean freight landscape with you and help you plan your shipments with more confidence.”