Container demand: a catalyst for disruption

We recently published our 2021 Hillebrand Gori Sea Shipping Report to help you navigate around two recent, yet persistent, hurdles in the industry; spiking freight shipping rates and the global container shortage crisis.

Now, new research by our experts highlights that not only is there a serious deficit and poor distribution of existing shipping containers due to the knock-on effects of the pandemic (we explain why here), but we face an enormous and unrelenting container demand in 2021, eclipsing available supply. It is a grave issue for the entire trade industry.

Find out why: access the Full March 2021 State of the Industry shipping container market report here.

Surging global container demand, especially on the transpacific

The economic restrictions from the pandemic directed consumer spending principally towards products rather than services.

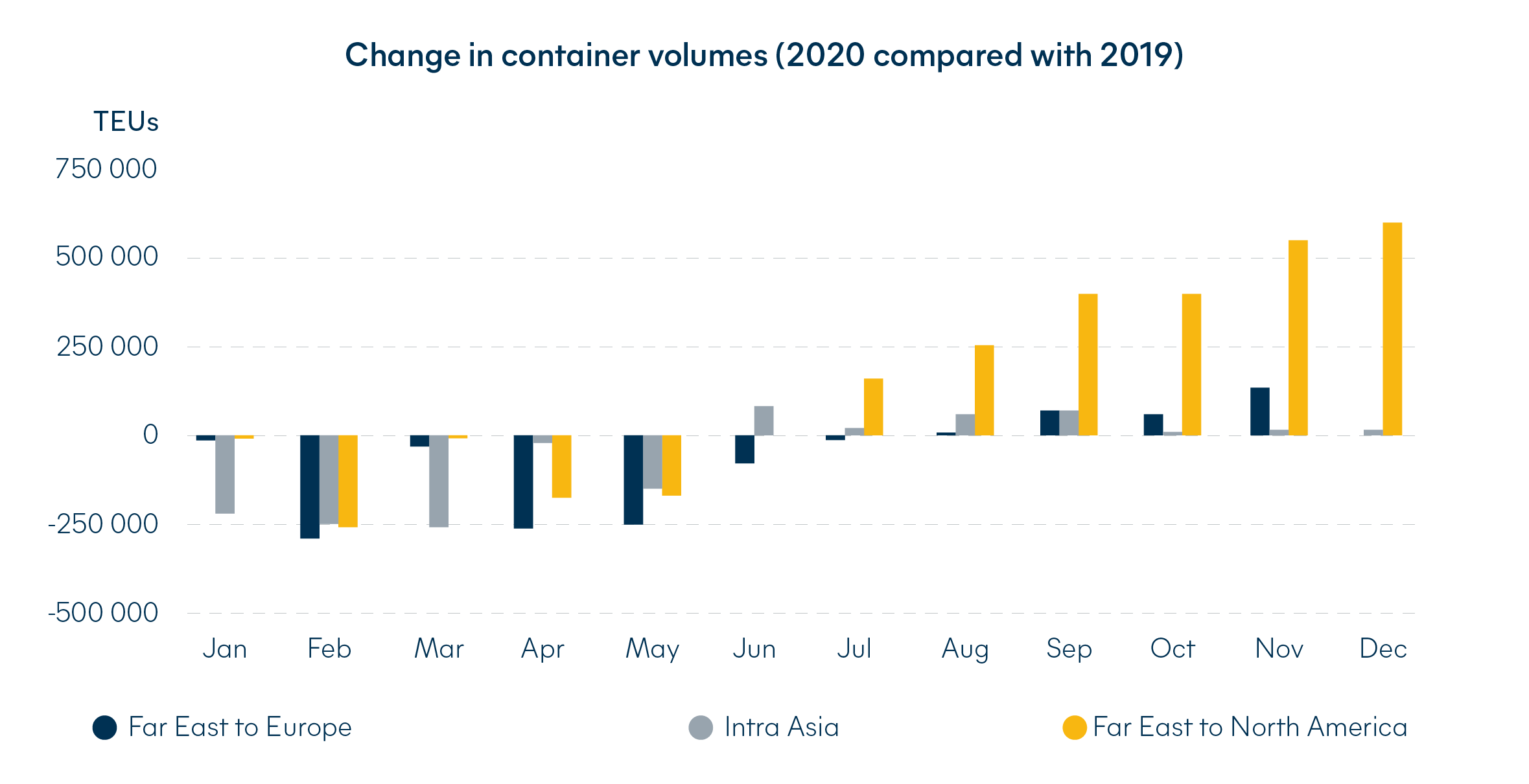

Most of these goods originated in Asia and the Far East, those being the regions to resume export first, as explained in more depth on our blog back in January. By the end of summer 2020, container volumes were booming, and have been rising steeply every month. Q4 2020 saw the Transpacific YoY growth in container volumes reach a massive 30%, a trend that has continued into Q1 2021, and shows no signs of slowing down.

Caption: Container volumes show a drastic increase in the second half of 2020, a trend which is continuing into 2021.

While the Transpacific shows the most dramatic change out of all trade routes, all regions and all ports around the world continue to face major YoY growth in container volumes. In recent months, international carriers have deployed any and all capacity available in an attempt to meet surging container demand, to the point where the global ‘idle fleet’ has reached the lowest count since a decade.

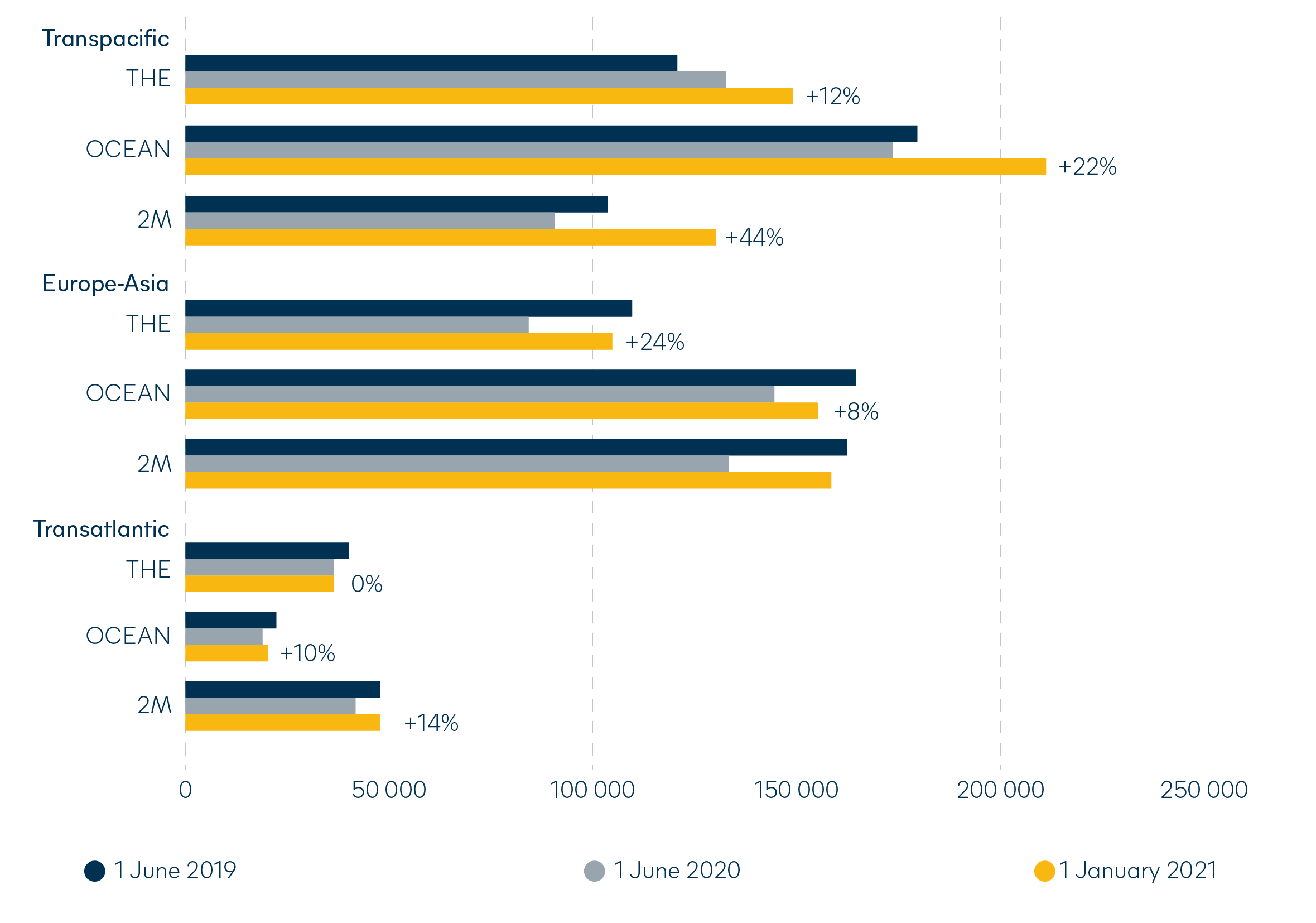

All key trade routes indicate strongly positive growth in YoY capacity. Nonetheless, there is still huge under capacity on every single trade route worldwide.

Caption: Key trade routes display positive YoY capacity growth in January 2021 compared to June 2020, but it’s not sufficient to meet current demand.

Freight rates remain at record highs

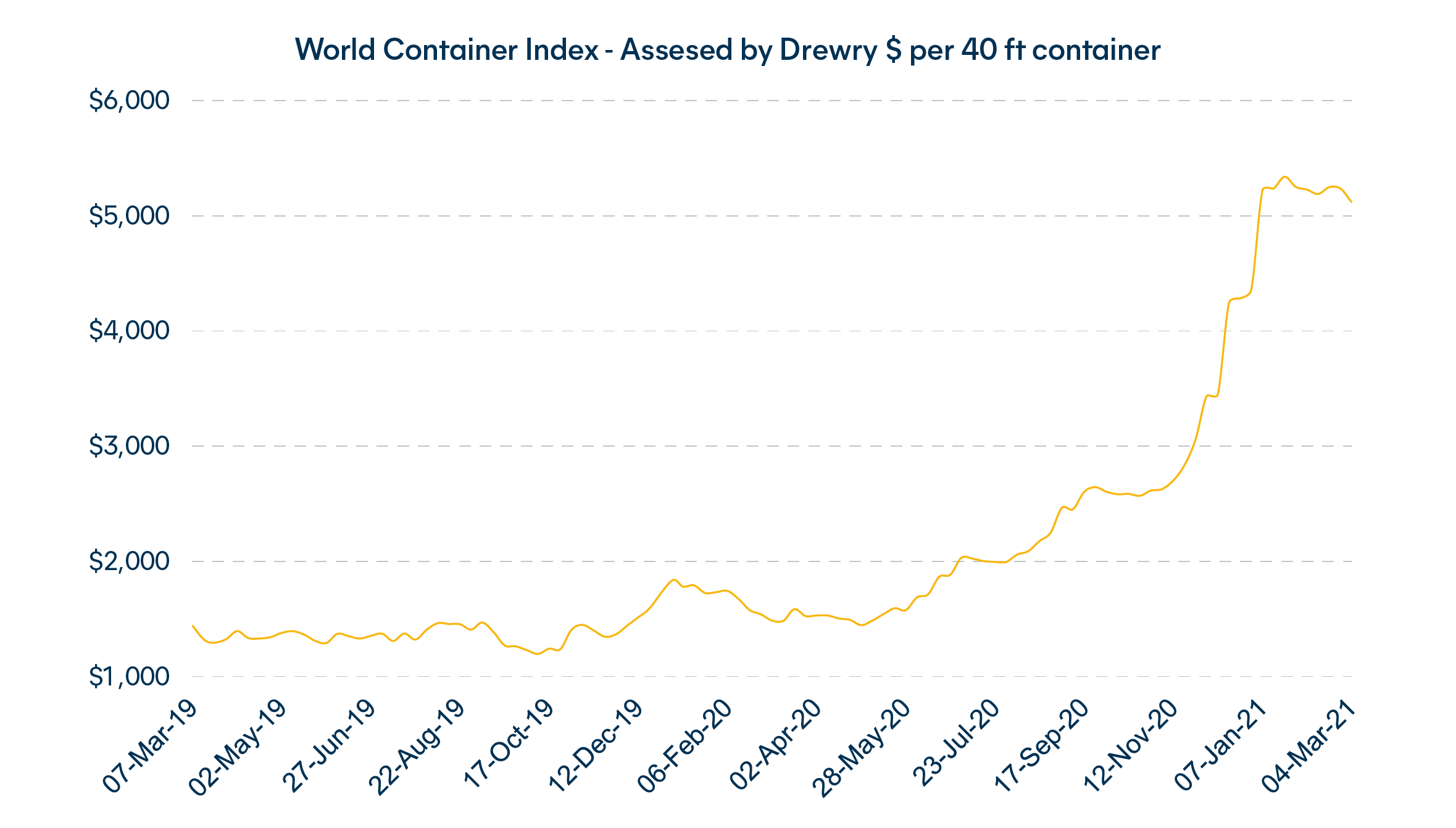

As we covered in our 2020 end of year industry review, shipping rates began a sharp upward growth trajectory that summer.

In 2021, the Freight Index from Drewry reported an average spot rate of over $5000 per 40ft container, and it remains stable at that high price. This indicates shipping rates have more than tripled in a single year. Clearly, a decisive challenge for any supply chain.

Caption: Current freight shipping rates are at record highs compared to the previous two years.

Source: Drewry World Container Index

Container demand: shipping industry struggles to cope, unrest grows

Volatility in the industry is unsurprisingly high.

Disarray has cascaded down supply chains creating a negative feedback loop of:

- Hold-ups

- Roll-overs

- Congestion

- Equipment and manpower deficit

- Free-times pressure

As stress builds, working conditions and service levels deteriorate. Labor unrest was on the rise; Oceania, USA and Canada faced the threat of workforce strikes. According to SeaIntelligence, overall schedule integrity reached an all-time low of 45% in December 2020, a serious blow to the industry. You’re likely wondering; how will supply chains recover in 2021 and beyond?

Immense container demand and operational costs

Container capacity is predicted to grow by a mere 2.5% in 2021, which is unfortunately far behind the current container demand surge.

Moreover, overall operational costs and surcharges are increasing greatly throughout the industry, including:

- Port and intermodal congestion costs

- Ports demurrage

- Equipment leasing fees

- Terminal handling charges

- Peak season charges

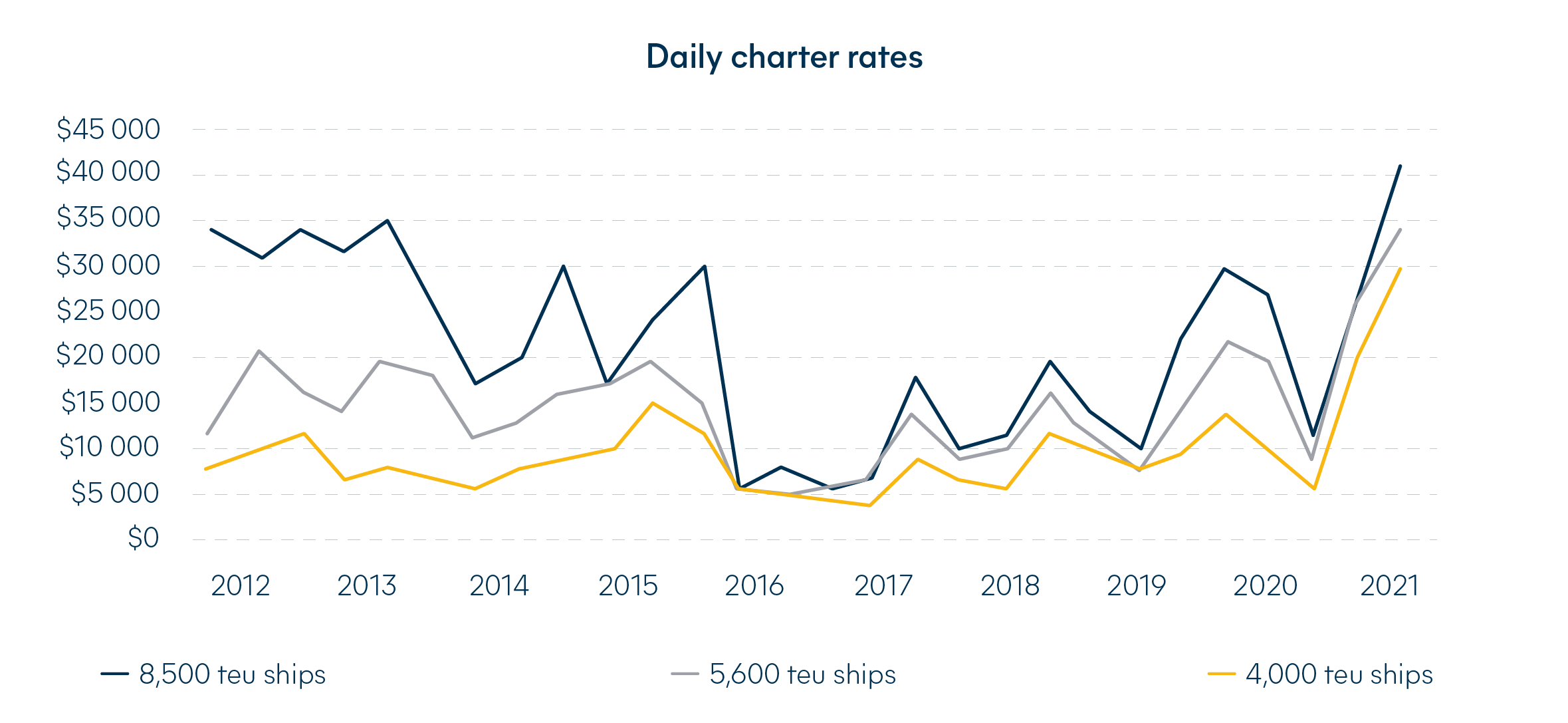

- Vessel charter rates

- Freight rates

- Fuel

It’s a lot to deal with.

Caption: Daily charter rates underwent a sharp uptick last year, and have climbed to a record high in 2021

Are shipping containers still in demand?

As of Feb 2023, industry experts expect the global shipping container market to reach $18,241.36 million by 2027.

Now the industry is grappling with a new hurdle: an excess of containers and a decline in demand. Shippers and traders believe the shift in global consumer demand represents a slowdown in new orders.

Logistics data shows storage depots that hold containers are quickly filling up while container prices fall.

According to Drewry’s composite World Container Index, container prices dropped to $1,997.22 per 40-foot container the week of Feb. 9, 2023. That’s 79% lower than the rate that same week in February last year.

Overcoming adversity and the journey ahead

The situation we are in today may seem insurmountable and never-ending, but there is light on the horizon.

The shipping industry is resilient, and adaptable.

Moving forward, our advice to shippers is to ensure they deliver commitments to protect allocations, anticipate reduced free times and to follow Hillebrand Gori’s six fundamental steps to sea freight shipping in precarious times.

It’s our priority to help you through the challenging year ahead. We have both the experience and versatility to adapt to unforeseen circumstances and find novel approaches to sail smoothly around obstacles.

Get in touch with us to discuss how we can best protect your supply chains.

.png?sfvrsn=c3460e9d_1)