Brexit 2021 traders update: what the new UK-EU trade deal means for you

A new year has dawned, and as of January 1st 2021 the Brexit transition period is officially at an end. The UK has left the EU customs union, and from here on out new 2021 post-Brexit trade rules are in full effect. An important and game-changing free trade agreement (FTA), also known as the UK-EU Trade and Cooperation Agreement (TCA) was brokered on Christmas Eve 2020, and this TCA will impact European and UK logistics customers in several crucial ways.

As the full TCA document is over 1,200 pages long, we’ll sum up the most relevant updated Brexit rules for UK and EU traders below, with links to in-depth resources throughout the article as well as listed at the bottom of this page.

The new Brexit trade agreement : 4 key additions

- Zero tariffs or quotas for UK and EU originating goods

One piece of very good news to come out of the TCA is that the UK and EU member countries have tariff-free, quota-free access to each other's markets. However, only if the goods in question are accompanied by proof of origin - and the origin must be UK or EU to qualify.

To check whether your goods are subject to any trade tariffs, please refer to the ‘rules of origin’ chapter in the trade agreement or check online on the UK government's official page for UK trade tariffs.

Please note that all goods being traded between the UK and the EU require a commercial invoice, as well as other documentation including EORI numbers and more.

Our previous Brexit blog post provides a handy overview of import and export requirements, but the most up-to-date source remains the UK government’s Border Operating Model. For a useful compiled list of updated official resources, please scroll to the end of this article. - Full bilateral cumulation between UK and EU

Full bilateral cumulation (cumulation of both materials and processing) has been agreed between the UK and the EU, allowing EU inputs and processing to be counted as UK input in UK products exported to the EU and vice versa. The ambitious arrangements include facilitations on average pricing, accounting segregation for certain products, as well as all materials, and tolerance by value. The rules are also supported by predictable and low cost administrative arrangements for proving origin.

To find out the details and what this means for your business, refer to the full EU-UK trade agreement or get in touch with us to consult an expert. - Simplified wine trading rules and postponed import certification

The latest Brexit free trade agreement offers slight relief for a previously very worried wine industry. Costs for exporters and consumers will be buffered by simplified certification, documentation, labelling and packaging requirements (see this Annex on page 515 of the TCA).

However, there may still be mandatory paperwork to fill in (the dreaded Vl-1 forms) that could wind up as costly and time-consuming red tape for traders. These Vl-1 forms are currently strongly lobbied in parliament, and the UK government has agreed to suspend import certification for wine coming in from the EU until at least July 1st 2021. EU arrangements for third country wine will remain as they are.

For a good overview of the new Brexit rules for wine trading, including the new free trade TCA considerations, the wine import and export summary page on the UK government’s official website is essential reading.

Should you wish to transport wine to the UK before the summer and avoid the imminent paperwork headache, the time to do so is now. The world is still in the midst of a container shortage crisis, so early booking of shipments is essential. As specialists in the freight of alcohol and other excise goods, our team is here to help you transport your excise goods across borders as quickly and smoothly as possible. - Refined technical and market regulations

The Technical Barriers to Trade (TBT) chapter in the UK-EU trade agreement allows both parties the freedom to regulate goods in the way most appropriate for their own market. It addresses technical regulation, conformity assessment, standardisation, accreditation, market surveillance, and marking and labelling.

The mandatory marking, labelling and marketing standards that are now in full effect are explained on the UK Government’s website.

Introducing the 'Northern Ireland Protocol'

Although a part of the UK, Northern Ireland nonetheless begins implementing new border formalities with Great Britain in order to keep an open land border with the Irish Republic, an EU member. Northern Ireland remains aligned to the EU Single Market for goods and will follow EU customs rules, although it leaves the Customs Union along with the rest of the UK.

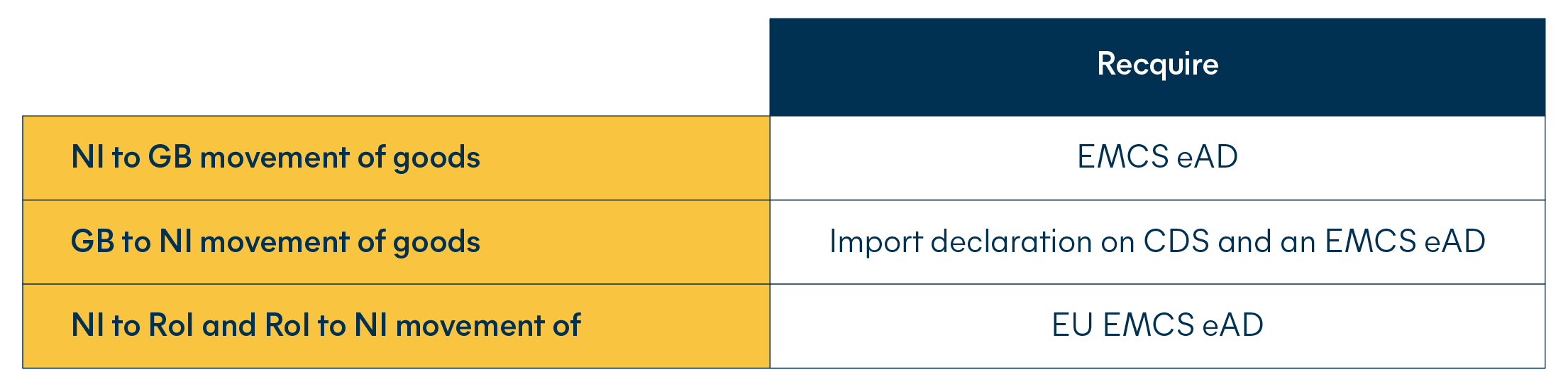

This new Northern Ireland protocol also applies to goods being routed through Northern Ireland with their final destination elsewhere. The following paperwork and declarations are mandatory for customs procedures between the distinct regions:

There is a useful free Trader Support Service from the UK government that will help clear up any confusion or doubts about the Northern Ireland Protocol. This portal also allows traders to directly access the customs system. The Hillebrand customs team can also guide you through the required paperwork if you are trading between Northern Ireland and Great Britain, simply get in touch with our experts.

Embarking Upon a New Era of Trade

The start of post-Brexit trading will certainly not be smooth sailing, but we at Hillebrand are here to navigate you through. We deal with over 16,000 cargo entries into the UK every month, and our customs team already manages a quarter of a million clearances per year. We are a registered HMRC trusted trader at all major UK ports, and one of the most experienced UK customs handlers in the world. If you have doubts or questions about post-Brexit trading to or from the UK in 2021, please contact our experts.

Useful Links: Trading Post-Brexit

All sources link to continuously updated pages on the UK Government’s website.

The Border with the European Union: Importing and Exporting Goods

Trade Tariffs: look up commodity codes, duty and VAT rates

Marking, labelling and marketing standards for imports and exports

Moving goods into, out of, or through Northern Ireland from 1 January 2021